In 2021, China's shipments of smart home devices exceeded 220 million units. Where is the marke

On March 31, IDC, a well-known market research institution, released the quarterly tracking report of China's smart home device market, the fourth quarter of 2021. The report shows that in the fourth quarter of 2021, China's smart home equipment market shipped 63.37 million units, a year-on-year increase of 4.1%. In 2021, the shipment volume of China's smart home equipment market exceeded 220 million units, with a year-on-year increase of 9.2%.

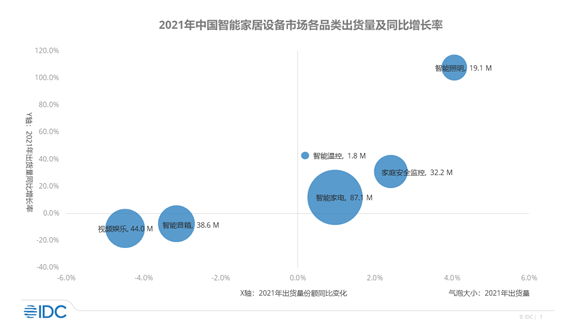

Shipments of smart home devices in China in 2021

In 2021, the intelligent lighting equipment market will maintain rapid growth, and users' demand for intelligent lighting will gradually deepen. On the one hand, the types of lighting equipment are diversified, downlights and track lights have joined the ranks of intelligence, and the smart switch market has also ushered in a surge. On the other hand, the market acceptance of intelligent lighting solutions is high, which has become an important component of the whole house intelligence.

In 2021, the market growth and upgrading of family safety monitoring equipment go hand in hand. Among them, the product iteration caused by the significant improvement of video surveillance resolution is one of the important reasons to promote the growth of smart camera and visual doorbell Market in 2021. With the combination of camera, display screen and AI technology, the intelligent door lock market has further upgraded its product functions, and the market shipment has maintained a rapid growth. In 2021, the proportion of cat eye lock has increased to 22.3%, and the penetration rate of face recognition function has reached 13.6%.

In 2021, the shipment volume of smart speaker Market contracted year-on-year, but under the structural adjustment and product upgrading, the market sales increased by 15% year-on-year.

In 2021, the shipment volume of video entertainment equipment market further declined. Among them, the shipment volume of smart TV market in 2021 was 38.86 million units, a year-on-year decrease of 9.4%.

With the increasingly fierce competition in the industry, the whole house intelligence is imperative

From the perspective of market pattern, the current smart home market can be said to be a stage for players in the industry to make the cake bigger, but the competition is also very fierce.

First of all, Xiaomi has always insisted on "mobile phone" × The strategy of "aiot" began to layout smart home a long time ago and invested many excellent Xiaomi ecological chain enterprises. Although everyone performs their respective duties, they are also in the Mijia ecosystem. For consumers, they can experience a more mature and perfect smart home experience.

Compared with Xiaomi, Huawei's whole house intelligent strategy is more open and can directly cooperate with large manufacturers with experience and strength. After the mobile phone business was sanctioned, whole house intelligence has become an important breakthrough for Huawei, and we can also feel Huawei's determination to do a good job in whole house intelligence.

Not to mention traditional home appliance manufacturers, although Xiaomi, Huawei and other manufacturers are coming in, Haier, Midea, Gree and other manufacturers are also actively applying the general trend of smart home, such as the launch of Haier smart home, such as Midea's comprehensive digital and intelligent layout. In addition, traditional home appliance manufacturers have great advantages in sales channels and can better promote products.

From the perspective of products, the early smart home has more knowledge about the intelligent experience of a single product, such as door locks, floor sweeping robots, cameras and other products. The intelligent experience is limited to the product itself, and the intelligent interactive experience of each product may be different. When consumers experience smart home, it will be accompanied by many pain points that are separated and products cannot be interconnected.

With the development of the supply chain and the reduction of the cost of various modules, manufacturers are more and more aware that the whole house smart home experience is the focus of future development, that is, to build an intelligent system to open up not only the interconnection between products, but also the intelligent interaction between products and people.

How will 2022 move from upgrading to growth?

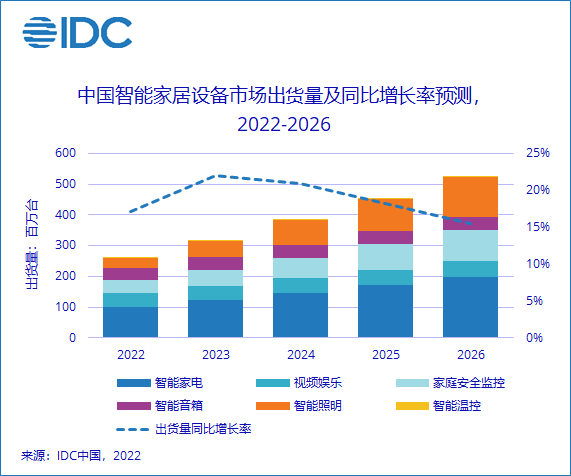

On the whole, although the market has not seen a double-digit rebound under the pressure of both supply and demand, what can not be ignored behind the volume of shipments is the upgrading and adjustment of China's smart home market. In the continuous optimization, the market will usher in new development opportunities. It is expected that the shipment volume of China's smart home equipment market will exceed 260 million units in 2022, with a year-on-year increase of 17.1%.

Liu Yun, senior analyst of IDC China, believes that: "China's smart home market has undergone upgrading and adjustment in 2021. In order to transform upgrading into growth and speed up the promotion and penetration of smart home in 2022, manufacturers should not only strengthen product upgrading iteratively to tap market demand, but also pay attention to sales operation, especially strengthen the marketing of products in medium and high price segments, so as to stimulate the upgrading of consumer demand. In addition, channel upgrading will also become the key for manufacturers to optimize user access quality, enhance market awareness One of the important ways to speed up the pace of market education. "

In 2021, all kinds of smart home device markets have experienced varying degrees of product structure adjustment and function upgrading, laying the foundation for the subsequent development of the market. In 2022, the following three points are worth paying attention to how the smart home market will transform upgrading into growth.

Polish products and combine intelligence and function to realize effective upgrading

With the development of smart home market becoming more rational, the starting point for consumers to buy smart home devices has gradually shifted from early taste to product function and quality. Therefore, manufacturers need to pay more attention to the product's own attributes in addition to the novelty brought by intelligence, combine AI ability with product function, and stimulate consumers' purchase demand through intelligent experience in details.

Fine operation and expand market opportunities in medium and high price segments

Over the past year, driven by product upgrading and rising costs, the average price of China's smart home equipment market has increased significantly, with a significant increase in the market share of high-priced segments in smart TVs, smart speakers, floor sweeping robots and other categories. With the maturity of technology and the decline of the cost of some components, the price of products in the medium and high-end market will usher in more room for adjustment in 2022. Under the general trend of market upgrading, the refined sales operation of products in medium and high price segments is expected to further increase the market demand in medium and high price segments.

Upgrade channels and reduce user learning costs through high-quality touch

The popularity of smart home market in China has not been realized for several years. On the one hand, there are still a large number of users who don't understand smart home, and there are many potential consumers who stop out of concern about complex settings.

Therefore, manufacturers not only need to simplify the operation steps from the product side, but also need to upgrade the channel services, improve the professionalism of front-line staff to improve the touch quality, and actively cooperate with offline channels such as home decoration, strengthen demonstration, reduce user learning costs and speed up the user education process.